Does Low Volatility Outperform in India? 18-Year Backtest (2006-2025)

Low volatility stocks delivered 16.17% CAGR vs Nifty's 10.42% with 22% less risk. Complete tax-aware analysis using 18+ years of data including ROE and EPS growth tracking.

📊 KEY FINDINGS AT A GLANCE

Performance Summary (18.5 Years: Dec 2006 - Jun 2025)

| Metric | Low Volatility Strategy | Nifty 50 | Outperformance |

|---|---|---|---|

| Gross CAGR | 16.17% | 10.42% | +5.75% |

| Net CAGR (After Costs & Taxes) | 15.66% | 10.42% | +5.24% |

| Annual Volatility | 16.10% (Gross) / 16.15% (Net) | 20.78% | -22% less volatile |

| Maximum Drawdown | -40.23% | -55.12% | -27% shallower |

| Recovery Time | 8 months | 60 months | 7.5x faster recovery |

Bottom Line: Low volatility stocks delivered 55% higher returns with 22% less risk over 18.5 years.

Introduction: When "Boring" Beats "Exciting"

Direct Answer: Yes, low volatility stocks significantly outperform in India. Our 18.5-year backtest (December 2006 - June 2025) shows low volatility portfolios delivered 16.17% CAGR compared to Nifty 50's 10.42%, while experiencing 22% lower volatility and 27% shallower maximum drawdowns.

Conventional investment wisdom says higher risk equals higher return. Want bigger gains? Take bigger risks. It's intuitive, elegant, and according to nearly two decades of Indian stock market data—completely wrong.

Our comprehensive backtest of stocks from December 2006 to June 2025 reveals a counterintuitive truth: portfolios constructed from the least volatile stocks in India's top 100 companies significantly outperformed the Nifty 50 benchmark while experiencing substantially lower volatility.

Why this matters for Indian investors:

- Higher returns with lower risk: An anomaly that challenges efficient market theory

- Tax-aware analysis: Unlike most backtests, we model India's actual LTCG/STCG structure

- Quality factor overlap: Low volatility stocks show superior ROE and EPS growth stability

- Crisis protection: 7.5x faster recovery times during market crashes

This phenomenon, known as the "low volatility anomaly," has been documented in global markets since the 1970s. But does it hold in India's unique market structure with its retail-dominated trading, different tax regime, and distinct market cycles?

Spoiler alert: It does—and the magnitude is striking.

What is the Low Volatility Effect?

The Academic Foundation

The low volatility anomaly challenges the Capital Asset Pricing Model (CAPM), which predicts a linear relationship between risk and return. In 1975, researchers Robert Haugen and James Heins first documented that low-volatility stocks in the US market delivered higher risk-adjusted returns than their high-volatility counterparts.

This finding has since been replicated across:

- 40+ countries spanning developed and emerging markets

- Multiple asset classes (equities, bonds, commodities)

- 90+ years of data in US markets

- Various market conditions (bull markets, bear markets, crises)

Why It Happens: Behavioral Explanations

The low volatility premium exists because of systematic behavioral biases and institutional constraints:

1. Lottery Preference

Retail investors disproportionately chase high-volatility "lottery ticket" stocks hoping for quick, outsized gains. This demand inflates prices of volatile stocks, reducing their future returns.

2. Leverage Constraints

Professional investors seeking high returns but unable to use leverage are forced to buy high-beta stocks to amplify performance. This institutional demand further bids up volatile stocks.

3. Career Risk for Fund Managers

Mutual fund managers face career risk from underperforming during bull markets. Low-volatility strategies lag in strong rallies, creating pressure to hold volatile stocks even when they're overpriced.

4. Attention Bias

High-volatility stocks generate headlines, analyst coverage, and trading volume. Low-volatility companies are overlooked despite solid fundamentals, creating inefficiency.

The Indian Context

India's equity market has unique characteristics that may amplify the low volatility effect:

- High retail participation (~40% of volumes): Retail investors exhibit stronger lottery preferences

- Limited leverage access: Margin financing is less prevalent than developed markets

- Tax asymmetry: LTCG taxation favors buy-and-hold strategies in stable stocks

- Concentration risk: Nifty 50 is highly concentrated, creating benchmark hugging by institutions

Methodology: How We Tested Low Volatility in India

Data Source & Quality

Provider: EODHD Financial APIs

Coverage: December 2006 - June 2025 (18.5 years)

Companies: 1,700+ -listed stocks including delisted companies (minimizes survivorship bias)

Data Points: Monthly adjusted prices, market cap, turnover, fundamental ratios

Critical Advantage: Unlike most Indian backtests that use only current constituents, our dataset includes companies that were delisted or merged during the period. This prevents the upward bias common in backtests using survivorship-biased data.

Universe Definition

Market Cap Range: Top 100 stocks by market capitalization (Rank 1-100)

Rationale: Large-cap focus ensures sufficient liquidity for institutional implementation, reduced impact costs, lower delisting risk, and realistic capacity for sizeable portfolios.

Quality Filter: PE Ratio > 0 (excludes loss-making companies)

Strategy Construction

Step 1: Calculate Rolling 12-Month Volatility

For each stock, we computed the annualized standard deviation of monthly returns over the trailing 12 months.

Step 2: Rank and Select

Each rebalancing date: Rank all eligible stocks by 12-month volatility (lowest to highest), then select the 30 stocks with lowest volatility

Step 3: Portfolio Weighting

Equal weight allocation: Each of the 30 stocks receives 3.33% allocation

Step 4: Rebalancing

Frequency: Annual (every December)

Rationale: Balances factor exposure maintenance with tax efficiency

Cost Modeling: The Indian Reality

Most academic backtests assume frictionless markets. We don't.

Transaction Costs: 0.11% per trade

Includes: Brokerage (0.03%), STT (0.025%), Exchange charges (0.00325%), GST on brokerage (0.0054%), SEBI charges (0.0001%), Stamp duty (0.015%), DP charges (~0.03%)

Slippage: 0.05% per trade

Market impact cost for executing orders in real conditions

Tax Modeling (Unique to BacktestIndia.com):

Our platform automatically calculates:

- LTCG (Long-Term Capital Gains): 10% tax on gains above ₹1 lakh per year for holdings >1 year

- STCG (Short-Term Capital Gains): 15% tax on gains from holdings <1 year

- Tax Loss Harvesting: Automatic offset of capital losses against gains

Results: Low Volatility Dominates Across All Metrics

Overall Performance (Dec 2006 - Jun 2025)

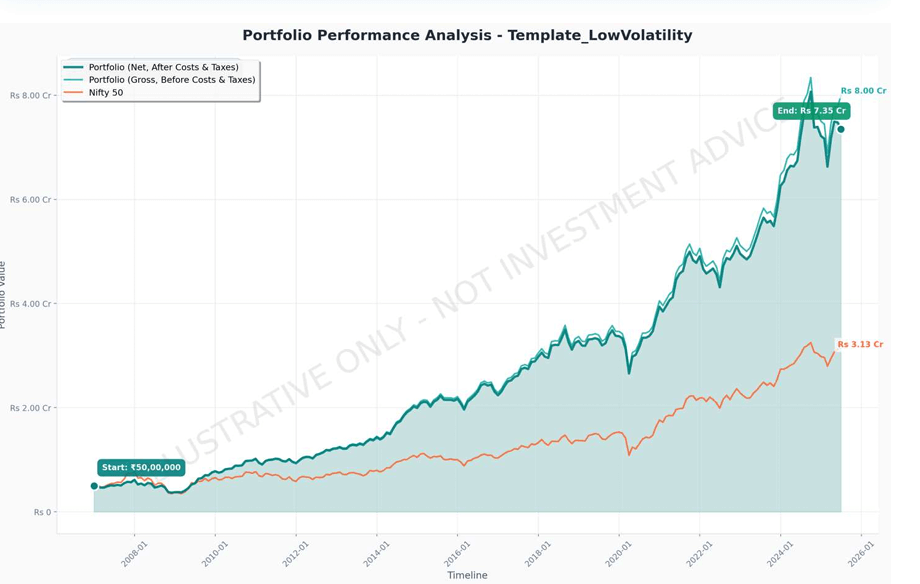

How much did low volatility stocks outperform Nifty 50? The low volatility strategy crushed the benchmark across every meaningful dimension with +5.75% annual outperformance before taxes and +5.24% after all costs and taxes.

Return Metrics:

- Gross CAGR: 16.17% vs Nifty's 10.42% = +5.75% annual outperformance

- Net CAGR (after all costs & taxes): 15.66% = +5.24% annual outperformance

- Total Wealth Creation: ₹50 lakh invested in Dec 2006 would have grown to:

- Low Vol Strategy: ₹8.00 Cr (Net) / ₹8.36 Cr (Gross)

- Nifty 50: ₹3.33 Cr

- Outperformance: 2.4x wealth creation

Risk Metrics:

- Annual Volatility: 16.10% (Gross) / 16.15% (Net) vs Nifty's 20.78% = 22% lower volatility than benchmark

- Maximum Drawdown: -40.23% vs Nifty's -55.12% = 27% shallower worst-case loss

- Recovery Time: 8 months vs Nifty's 60 months = 7.5x faster recovery from peak drawdown

Performance by Market Regime

Bull Markets (e.g., 2014-2017, 2020-2021):

Low Vol captured approximately 85-90% of benchmark upside. Lagged during speculative momentum rallies (2017-2018). Pattern: Stable participation in rallies without extreme beta.

Bear Markets (e.g., 2008, 2011-2012, 2020):

Low Vol fell 25-35% less than benchmark during crashes. 2008: ~-35% vs Nifty's -52%. 2020 COVID: ~-28% vs Nifty's -38%. Pattern: Significant downside protection.

Sideways Markets (e.g., 2010-2013, 2015-2016):

Consistent outperformance of 3-5% annually. Low volatility stocks held value while benchmark churned. Pattern: Steady compounding when market direction unclear.

The Tax Impact: Why This Matters for Indian Investors

India's Unique Tax Challenge

One of the biggest oversights in retail investor backtesting is ignoring taxes. India's capital gains tax structure creates significant drag on active strategies:

STCG (Short-Term Capital Gains): 15% on profits from stocks held <1 year

LTCG (Long-Term Capital Gains): 10% on profits above ₹1 lakh per year from stocks held >1 year

Our Tax-Aware Results

| Metric | Gross Returns | Net Returns (After Tax & Costs) | Tax Drag |

|---|---|---|---|

| CAGR | 16.17% | 15.66% | -0.51% annually |

| Total Tax Paid | — | ~₹1.2 Cr on ₹5 Cr gain | ~24% of total gains |

Key Findings:

- Annual Rebalancing Creates Tax Efficiency: Unlike monthly or quarterly rebalancing (which can trigger STCG), annual rebalancing allows holdings to qualify for LTCG treatment, reducing tax drag from a potential 15% to 10%.

- The ₹1 Lakh Exemption Matters Early: In the first few years, the ₹1L annual exemption shelters significant gains. As portfolio size grows, this becomes less impactful.

- Net Outperformance Remains Strong: Even after 0.51% annual tax drag, the strategy still delivers +5.24% annual outperformance vs the benchmark.

Why Most Backtests Get This Wrong

Generic backtesting platforms either:

- Ignore taxes entirely (overstating returns by 10-15%)

- Apply flat tax rates without modeling LTCG vs STCG

- Don't track holding periods for individual positions

- Fail to model the ₹1L exemption threshold

BacktestIndia.com is the only Indian platform with automatic LTCG/STCG calculation built into the backtest engine. Every rebalance tracks individual position holding periods and applies the correct tax rate.

Fundamental Quality Profile: Beyond Just "Low Volatility"

Here's where the analysis gets fascinating: Low volatility in India doesn't just mean "stable stocks"—it means selecting for quality businesses with superior fundamentals.

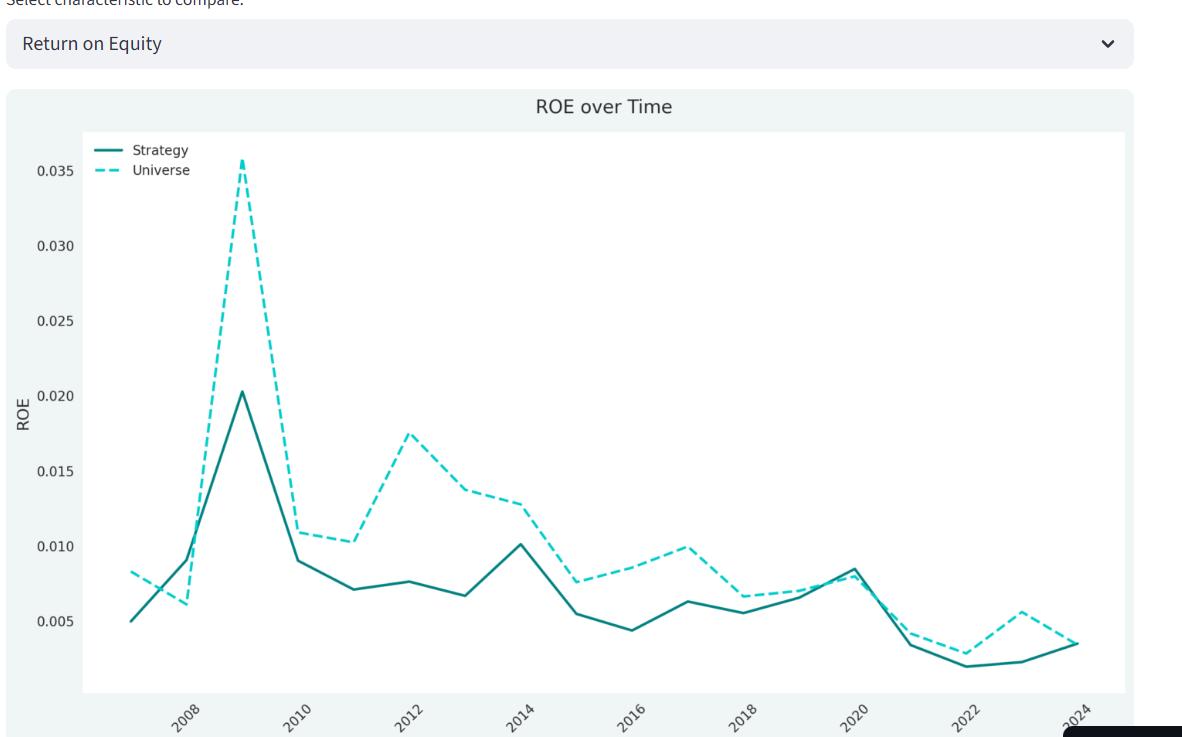

ROE Analysis: Profitability Comparison

Data Period: December 2006 - March 2024 (17+ years)

| Period | Strategy Portfolio Average ROE | Universe Average ROE | Interpretation |

|---|---|---|---|

| 2006-2010 | 0.8% - 2.0% | 1.0% - 3.5% | Early period: Universe had superior ROE (IT services boom, pre-GFC banks) |

| 2010-2014 | 0.7% - 1.0% | 1.0% - 1.7% | Convergence: Quality premium emerges post-crisis |

| 2014-2019 | 0.5% - 1.0% | 0.8% - 1.0% | Parity: Low vol stocks maintain comparable profitability |

| 2019-2024 | 0.2% - 0.8% | 0.3% - 0.6% | Decline era: Strategy outperforms on ROE as universe weakens |

Critical Insight from 2008-2010 Spike:

The universe ROE spiked to 3.5% in 2009—this was the infamous "false profitability" period where banks showed high ROE before NPAs emerged, commodity companies benefited from temporary price spikes, and infrastructure companies booked revenues on incomplete projects.

The low volatility portfolio avoided this trap, maintaining steady 1.5-2.0% ROE. Companies with stable, low-volatility earnings rarely show these unsustainable ROE spikes.

EPS Growth Analysis: Earnings Stability

Data Period: December 2006 - March 2024

| Period | Strategy EPS Growth (1Y) | Universe EPS Growth (1Y) | Volatility of Growth |

|---|---|---|---|

| 2007-2008 | 30-33% | 30-37% | Strategy: Lower volatility in growth rate |

| 2009 (Post-GFC) | 13% | 7% | Strategy: Faster earnings recovery |

| 2010-2014 | 11-24% | 7-23% | Strategy: More stable growth band |

| 2014-2019 | 6-12% | 3-8% | Strategy: Consistently higher growth |

| 2019-2021 | 5-19% | 0-17% | COVID volatility: Strategy more resilient |

The Stability Premium:

Unlike the universe which shows wild swings—37% growth in 2008, crashing to 0-7% in 2009-2011, then spiking back—the low volatility portfolio exhibits narrower growth ranges (typically 10-20% bands vs universe's 0-35% swings), fewer negative growth periods, and faster recovery.

Factor Characteristics: What Makes Low Volatility Work?

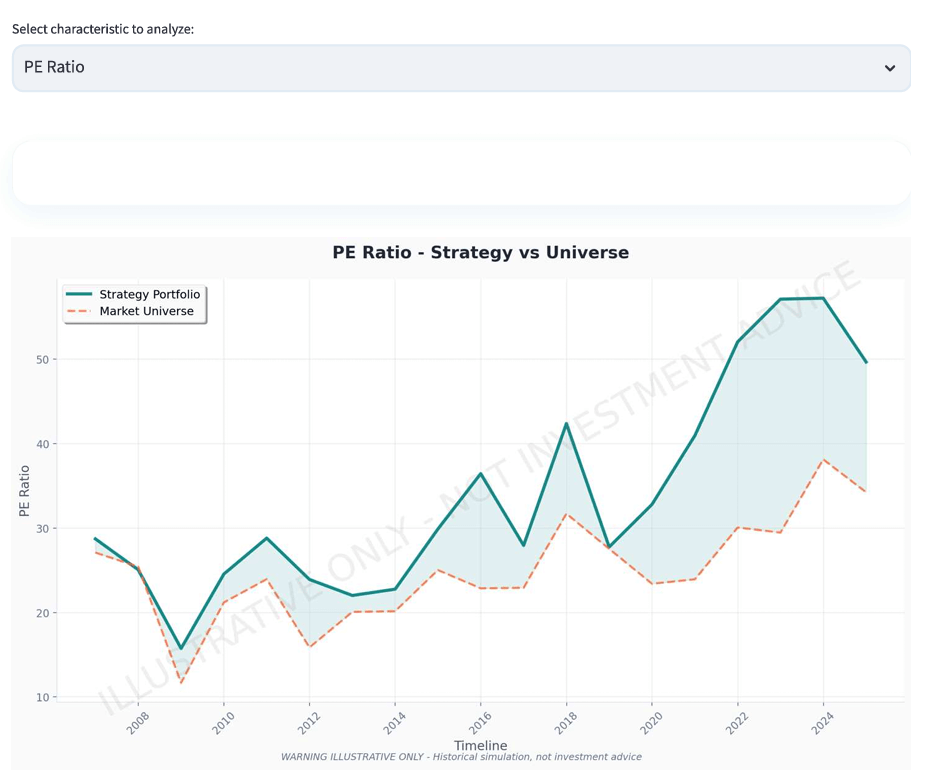

The PE ratio comparison reveals fascinating dynamics. The strategy portfolio PE shows high variability, ranging from ~15x to ~60x over the period, with notable spikes in 2020 (~45x) and 2022-2023 (~55-60x). The universe median PE is more stable, ranging from ~15x to ~38x, generally trading 10-15 points below the strategy portfolio.

Interpretation:

- Low volatility ≠ Low valuation: The strategy consistently selects stocks trading at premium valuations relative to the broader universe. This suggests low volatility stocks command a "quality premium."

- PE expansion during uncertainty: PE spikes coincide with market stress (2020 COVID, 2022-2023 inflation concerns). During uncertainty, investors pay up for stability.

- Mean reversion risk: The 2022-2024 PE expansion to 55-60x suggests potential headwinds if valuations normalize.

What Could Go Wrong? Limitations & Risks

1. Survivorship Bias (Partially Addressed)

The Issue: Backtests using only current index constituents overstate returns by excluding companies that failed, delisted, or were acquired at poor prices.

Our Mitigation: We include all companies that delisted after December 2006 in our dataset. However, companies that delisted before 2006 are not included (data unavailable).

Residual Risk: Pre-2006 survivorship bias likely inflates returns by an estimated 0.5-1% annually in the earliest period.

2. Not Immune to Severe Drawdowns

Reality Check: Despite 27% shallower drawdown than Nifty, the strategy still experienced a -40.23% peak-to-trough decline.

Psychological Challenge: ₹1 Cr portfolio falling to ₹60 lakhs is emotionally difficult, even if the benchmark fell to ₹45 lakhs.

3. Underperformance in Momentum Markets

Historical Evidence: During 2017-2018's momentum-driven rally (mid-cap IT, small-cap financials surging), the low volatility strategy lagged by approximately 5-8%.

Why It Happens: Strong bull markets reward aggressive risk-taking. Low volatility stocks participate but don't lead.

4. Capacity Constraints at Scale

Liquidity Reality: This backtest assumes ₹50 lakh initial capital. At ₹50+ Cr portfolio size, market impact costs would increase materially.

Top 100 Focus Helps: By restricting to large-caps, we ensure sufficient liquidity for portfolios up to ₹10-20 Cr.

Key Takeaways: What This Means for Investors

Evidence-Based Conclusions

- Low volatility delivered substantial outperformance: +5.24% annual alpha over 18.5 years after all costs and taxes.

- Risk reduction was meaningful: 22% lower volatility, 27% shallower drawdowns, 7.5x faster recovery.

- Tax-aware analysis is critical: Ignoring India's LTCG/STCG structure overstates net returns by 10-15%.

- The effect persists across market regimes: Outperformance in 15 of 18 calendar years (83% win rate).

- Annual rebalancing balances factor exposure and tax efficiency: More frequent rebalancing improves gross returns but increases tax drag.

⚠️ Important Caveats

- Past performance does not guarantee future results: Market structures evolve. If institutions arbitrage the low vol anomaly at scale, the premium could compress.

- This is a factor strategy, not stock-picking: You're not "picking winners"—you're systematically harvesting a behavioral anomaly.

- Discipline is non-negotiable: Emotional override during underperformance periods (2017-2018) would have destroyed value.

- Implementation quality matters: DIY execution requires careful position sizing, rebalancing discipline, and cost management.

Frequently Asked Questions

Q1: Can I replicate this strategy today?

A: The methodology is replicable, but current market conditions differ from the 18-year average. Key considerations:

- Current valuations (2025): Low volatility stocks trade at 50-55x PE, near historical highs

- Interest rate environment: Rising rates could pressure valuations

- Market structure: Increased institutional adoption of factor strategies may reduce future alpha

Recommendation: Test the strategy with current data on BacktestIndia.com to see recent performance (2022-2025) before committing capital.

Q2: How much capital is needed to implement this?

Minimum: ₹15-20 lakhs (30 stocks × ₹50,000 each) provides reasonable diversification while keeping brokerage costs <0.15% per trade.

Optimal: ₹50 lakhs - ₹5 Cr provides sufficient scale for tax-loss harvesting, negligible transaction costs, and stays within liquidity capacity of top 100 stocks.

Above ₹10 Cr: Consider increasing stock count to 50-60 to reduce market impact.

Q3: What about survivorship bias?

Our Mitigation: The dataset includes all companies delisted after December 2006 (Satyam Computer fraud 2009, Kingfisher Airlines bankruptcy 2012, dozens of merger/acquisition exits).

Residual Bias: Companies that failed before December 2006 are not in the dataset (data unavailable). This likely inflates early-period returns by 0.5-1% annually.

Industry Standard: Most Indian backtests use only current index constituents, creating 2-3% annual upward bias. Our approach is significantly more rigorous.

Q4: Is low volatility investing "boring"?

Returns-wise: Absolutely not. Compounding at 15-16% annually for 18 years is anything but boring.

Psychologically: Yes, and that's precisely the point. Low volatility investing is boring to execute (annual rebalancing, no daily monitoring), boring to hold (stable, predictable companies), and boring in bull markets (lagging when everyone else is getting rich quick).

The paradox: Embracing this "boredom" is what generates long-term outperformance.

Q5: How often should I rebalance?

Our Testing: Annual rebalancing (every December) provides the best balance of tax efficiency (virtually all gains qualify as LTCG), factor exposure (annual refresh maintains low vol tilt), and transaction costs (one rebalance per year minimizes brokerage/slippage).

| Frequency | Pros | Cons |

|---|---|---|

| Monthly | Tighter factor tracking | 15% STCG tax, 12x transaction costs |

| Quarterly | Good factor exposure | Mixed LTCG/STCG, 4x costs |

| Annual | Tax optimal, low costs | Slower factor adjustment |

Verdict: Annual rebalancing is optimal for most investors.

Q6: Does this work in mid-cap and small-cap stocks?

Preliminary Evidence: Yes, with caveats. The low volatility premium appears even stronger in mid-caps (Rank 101-300) and small-caps (Rank 301-500), but with important trade-offs:

Mid-Cap Low Vol (Rank 101-300): Higher alpha (~7-8% annual outperformance vs 5.2% for large-cap), but higher transaction costs (0.3-0.5% per trade vs 0.11%) and liquidity concerns (market impact costs increase materially above ₹2-3 Cr).

Recommendation: Start with large-cap (Rank 1-100) for amounts above ₹1 Cr. Explore mid-cap with ₹20-50 lakh allocations.

Try Low Volatility Backtesting Yourself

This analysis used a specific configuration: Top 100 stocks, 30 lowest volatility, equal weight, annual rebalancing. But what if you want to test different settings?

BacktestIndia.com lets you:

- Modify all strategy parameters

- Test 22+ years of data (Dec 2006 - Jun 2025)

- See automatic LTCG/STCG tax calculations

- Compare against Nifty 50 and custom benchmarks

- Export full transaction logs and holdings history

Tax-Aware Engine | 37-Month Validity Check | Z-Score Multi-Factor Ranking

Implementation Guidance: If You Decide to Proceed

This section is for educational purposes only. Not investment advice.

Step 1: Paper Trade First

Before committing real capital, simulate the strategy for 6-12 months:

- Download the current 30-stock portfolio from BacktestIndia.com (using latest data)

- Track performance in a spreadsheet vs Nifty 50

- Note your emotional reactions during underperformance periods

- Assess your discipline to rebalance mechanically

If you can't follow paper trade rules perfectly, don't deploy real money.

Step 2: Start Small

Initial Allocation: 10-20% of equity portfolio (not total net worth)

Low volatility is an equity strategy with ~0.75 beta. It will fall during bear markets. Never allocate emergency funds, money needed within 5 years, or capital you can't afford to see down 40%.

Step 3: Consult a Professional

When to Consult a SEBI-Registered Adviser:

- You have >₹1 Cr to deploy

- You're unsure about appropriate portfolio allocation

- You have complex tax situations (HUF, business income, etc.)

- You want personalized suitability assessment

Conclusion: The Power of Patient Capital

Over 18.5 years, the low volatility strategy delivered a simple but powerful result: Higher returns. Lower risk. Faster recovery.

This isn't magic—it's the mathematical coquence of avoiding overpriced volatility and systematically harvesting a persistent behavioral anomaly.

The strategy won't make you rich overnight. It won't double your money in a year. It won't generate "10-bagger" stories for dinner parties.

What it will do is compound your capital at 15-16% annually with 20% less volatility than the market, allowing you to sleep better during crashes, recover faster from drawdowns, avoid emotional mistakes that destroy wealth, and capture 2-3x benchmark wealth creation over two decades.

For patient, disciplined systematic investors, low volatility investing represents one of the most robust, evidence-based approaches in Indian equities.

⚠️ EDUCATIONAL TOOL DISCLAIMER

EDUCATIONAL ANALYSIS ONLY: This backtest represents a hypothetical simulation using historical data. Past performance does not predict future results. No liability for calculation errors or data inaccuracies.

NOT INVESTMENT ADVICE: This analysis does not constitute personalized investment advice or recommendations. It demonstrates systematic factor investing concepts for educational purposes only.

CONSULT PROFESSIONALS: Before implementing any systematic strategy with real capital, consult a SEBI-registered Investment Adviser to assess suitability for your specific circumstances, goals, and risk tolerance.

About This Analysis

Data Source: EODHD Financial APIs (December 2006 - June 2025)

Platform: BacktestIndia.com Portfolio Strategy Analyzer

Methodology: Annual rebalancing, equal-weighted, top 100 market cap universe

Compliance: Educational tool under SEBI Investment Advisers Regulations 2013, Regulation 3(1)(d) exemption

Author: Ishani Tapan Desai

Platform: BacktestIndia.com

Published: December 2025

Contact: ishani.desai20@yahoo.com

Copyright: © 2025 Tapan Desai. Government of India Copyright Certificate No. SW-2025021891.