Momentum Investing India: 18-Year NSE Backtest (2006-2025)

Momentum stocks delivered 14.01% CAGR vs Nifty's 10.42%—but required surviving a brutal -70.53% drawdown. Complete tax-aware analysis using 18+ years of NSE data with PE, ROE, and EPS growth tracking.

📊 KEY FINDINGS AT A GLANCE

Performance Summary (18.5 Years: Dec 2006 - Jun 2025)

| Metric | Momentum Strategy | Nifty 50 | Difference |

|---|---|---|---|

| Gross CAGR | 15.23% | 10.42% | +4.81% |

| Net CAGR (After Costs & Taxes) | 14.01% | 10.42% | +3.59% |

| Annual Volatility | 22.85% (Gross) / 22.83% (Net) | 20.78% | +10% MORE volatile |

| Maximum Drawdown | -70.25% (Gross) / -70.53% (Net) | -55.12% | -28% DEEPER losses |

| Recovery Time | 68 months (Gross) / 65 months (Net) | 60 months | +8% SLOWER recovery |

Bottom Line: Momentum delivered 34% higher returns than Nifty but required surviving drawdowns 28% deeper and volatility 10% higher than the benchmark.

⚠️ CRITICAL WARNING: Not for Conservative Investors

The -70.53% maximum drawdown is not a typo. If you invested ₹1 Cr at the peak (Oct 2007), your portfolio would have fallen to ₹29.5 lakhs by Dec 2008—a loss of ₹70.5 lakhs. Recovery took 65 months (5.4 years). This strategy is only suitable for investors with exceptional risk tolerance and a minimum 10-year investment horizon.

📑 Table of Contents

- Introduction: The High-Octane Factor

- What is Momentum Investing?

- Methodology: How We Tested Momentum in India

- Results: Higher Returns, Brutal Volatility

- Head-to-Head: Momentum vs Low Volatility

- The Tax Impact: 6-Month Rebalancing Cost

- Fundamental Quality Profile

- Who Should Use Momentum vs Low Volatility?

- What Could Go Wrong? Limitations & Risks

- Key Takeaways

- Frequently Asked Questions

Introduction: The High-Octane Factor

Direct Answer: Yes, momentum investing works in India—but it's not for everyone. Our 18.5-year backtest (December 2006 - June 2025) shows momentum portfolios delivered 14.01% CAGR compared to Nifty 50's 10.42%, but required surviving a catastrophic -70.53% drawdown during the 2008 crisis and enduring volatility 10% higher than the market.

If low volatility investing is the tortoise—steady, defensive, boring—then momentum is the hare: fast, aggressive, and prone to spectacular crashes.

Momentum investing follows a deceptively simple rule: buy stocks that have been rising, sell stocks that have been falling. The strategy bets on trend continuation rather than mean reversion, capitalizing on one of the most persistent anomalies in financial markets.

Why this matters for Indian investors:

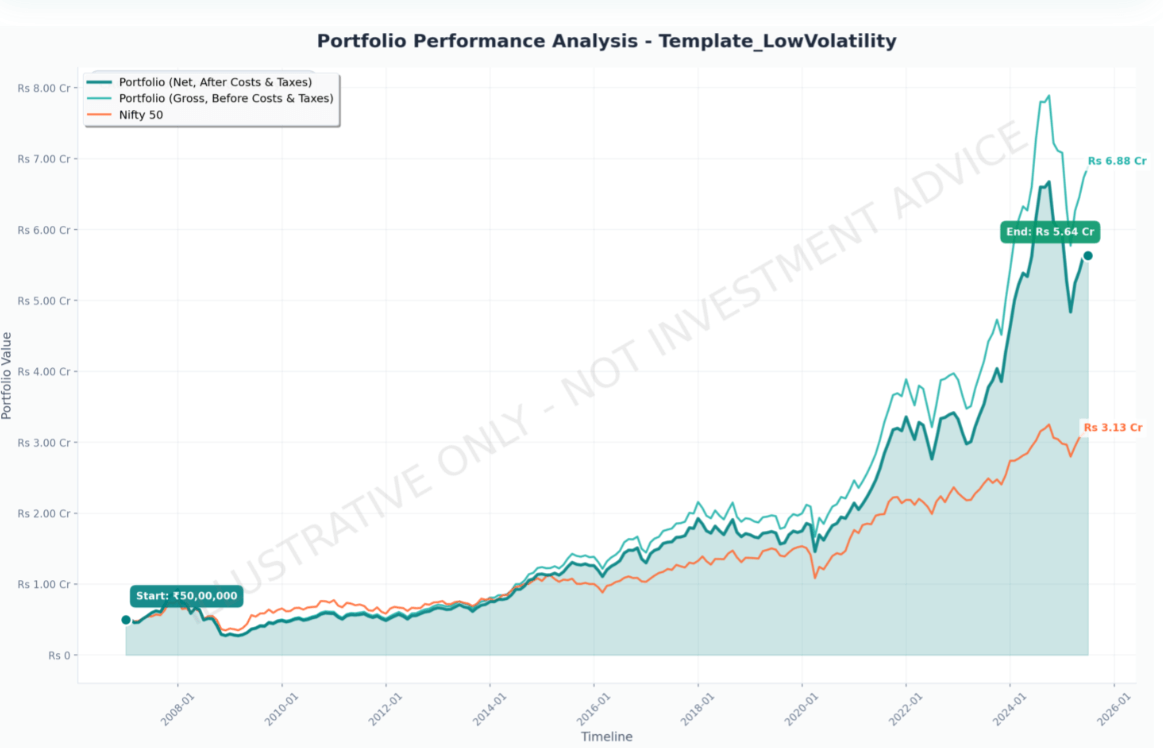

- Superior absolute returns: 14.01% CAGR turns ₹50 lakh into ₹5.64 Cr over 18.5 years (vs ₹3.33 Cr for Nifty)

- Tax-aware analysis: We model India's actual LTCG/STCG structure—6-month rebalancing triggers significant STCG (15%) vs LTCG (10%)

- Regime-dependent performance: Crushes it in bull markets (+139% in 2020-21), gets crushed in bear markets (-68% in 2008-09)

- Crisis amplification: Unlike defensive strategies, momentum amplifies market crashes rather than dampening them

Momentum has been documented globally since the 1990s, but does it persist in India's retail-dominated, high-turnover market? Can Indian investors stomach the volatility required to harvest these returns?

Spoiler alert: The returns are real, but the psychological toll is severe.

What is Momentum Investing?

The Academic Foundation

Momentum was first rigorously documented by Jegadeesh and Titman in their seminal 1993 paper "Returns to Buying Winners and Selling Losers: Implications for Stock Market Efficiency." They found that stocks with strong 3-12 month past returns continued outperforming over the next 3-12 months.

This finding has since been replicated across:

- 40+ countries including both developed and emerging markets

- Multiple asset classes (equities, bonds, commodities, currencies)

- 90+ years of US market data

- Various time periods including the Great Depression, World Wars, and modern crises

Unlike many financial anomalies that disappear after publication, momentum has persisted for 30+ years post-discovery, suggesting deep behavioral roots rather than data mining.

Why Momentum Works: Behavioral Explanations

1. Under-Reaction to Information

Investors systematically under-react to new information (earnings surprises, product launches, regulatory changes). Prices adjust slowly rather than instantly, creating exploitable trends. Academic research shows it takes 6-12 months for markets to fully incorporate fundamental news.

2. Herding Behavior

Once a stock starts trending, investors pile in based on "social proof" rather than fundamental analysis. This amplifies price movements beyond what fundamentals justify, extending trends for months or even years.

3. Anchoring Bias

Investors anchor to historical price levels and adjust slowly. A stock at ₹100 that rises to ₹150 is still "cheap" to anchored investors, delaying their buying decisions and allowing the trend to persist.

4. Disposition Effect

Retail investors hold losers too long (hoping to break even) and sell winners too quickly (locking in gains). This creates selling pressure on rising stocks that's absorbed slowly, allowing trends to continue.

The Indian Context

India's market has unique characteristics that may amplify momentum:

- Retail dominance: ~40% of NSE volumes come from retail investors who exhibit stronger behavioral biases

- Information asymmetry: Corporate disclosure gaps create delayed price discovery

- Promoter control: Concentrated ownership can amplify trends as promoters build/reduce stakes

- Sector rotation: India's rapid economic shifts create multi-year sector trends (IT in 2000s, infrastructure in 2005-08, digital in 2020s)

Methodology: How We Tested Momentum in India

Data Source & Quality

Provider: EODHD Financial APIs

Coverage: December 2006 - June 2025 (18.5 years)

Companies: 1,700+ NSE-listed stocks including delisted companies

Data Points: Monthly adjusted prices, market cap, fundamental ratios

Survivorship Bias Mitigation: Our dataset includes companies that were delisted or merged during the period, preventing the upward bias common in backtests that only use current index constituents.

Universe Definition

Market Cap Range: Top 200 stocks by market capitalization (Rank 1-200)

Rationale: Broader than our low volatility analysis (which used Top 100) to capture mid-cap momentum opportunities while maintaining sufficient liquidity.

Quality Filter: PE Ratio > 0 (excludes loss-making companies)

Why Top 200 vs Top 100? Momentum often emerges in smaller, faster-growing companies. Restricting to Top 100 would miss significant mid-cap opportunities. The Top 200 universe balances opportunity with liquidity constraints.

Strategy Construction

Step 1: Calculate Normalized 12-Month Momentum

For each stock, we computed: (Price Return over 12 months) / (12-month price volatility)

This "risk-adjusted momentum" metric prevents overweighting highly volatile stocks that happen to have strong absolute returns but inconsistent trends.

Step 2: Rank and Select

Each rebalancing date:

- Rank all eligible stocks by normalized momentum (highest to lowest)

- Select the 30 stocks with highest momentum

Step 3: Portfolio Weighting

Equal weight allocation: Each of the 30 stocks receives 3.33% allocation

Step 4: Rebalancing

Frequency: Semi-annual (every 6 months: June & December)

Rationale: Balances momentum exposure freshness with tax efficiency

Why 6-Month Rebalancing? Academic research shows 6-12 month formation periods capture optimal momentum. Shorter periods (1-3 months) capture short-term reversals rather than true momentum. Longer periods (18+ months) suffer from mean reversion. Six months also provides two rebalances annually, refreshing exposure to new trends while limiting tax drag.

Cost Modeling: The Indian Reality

Transaction Costs: 0.11% per trade

Includes: Brokerage (0.03%), STT (0.025%), Exchange charges (0.00325%), GST (0.0054%), SEBI charges (0.0001%), Stamp duty (0.015%), DP charges (~0.03%)

Slippage: 0.05% per trade

Market impact cost for executing orders in real conditions

Tax Modeling:

- LTCG (Long-Term Capital Gains): 10% tax on gains above ₹1 lakh per year for holdings >1 year

- STCG (Short-Term Capital Gains): 15% tax on gains from holdings <1 year

Critical Difference from Low Volatility: Six-month rebalancing means many positions are sold before reaching the 1-year LTCG threshold, triggering higher STCG tax rates. This creates significant tax drag compared to annual rebalancing strategies.

Results: Higher Returns, Brutal Volatility

Overall Performance (Dec 2006 - Jun 2025)

Return Metrics:

- Gross CAGR: 15.23% vs Nifty's 10.42% = +4.81% annual outperformance

- Net CAGR (after all costs & taxes): 14.01% = +3.59% annual outperformance

- Total Wealth Creation: ₹50 lakh invested in Dec 2006 would have grown to:

- Momentum Strategy: ₹6.88 Cr (Gross) / ₹5.64 Cr (Net)

- Nifty 50: ₹3.33 Cr

- Outperformance: 1.7x wealth creation (net)

Risk Metrics (The Brutal Reality):

- Annual Volatility: 22.85% (Gross) / 22.83% (Net) vs Nifty's 20.78% = 10% MORE volatile than benchmark

- Maximum Drawdown: -70.25% (Gross) / -70.53% (Net) vs Nifty's -55.12% = 28% deeper worst-case loss

- Recovery Time: 68 months (Gross) / 65 months (Net) vs Nifty's 60 months = Slower recovery despite higher returns

What -70.53% Actually Means: A ₹1 Cr portfolio invested in Oct 2007 fell to ₹29.5 lakhs by Dec 2008. You would have watched ₹70.5 lakhs evaporate in 14 months. It took until May 2014 to recover—5.4 years of watching your portfolio underwater. If you couldn't stomach this, momentum investing is not for you.

Performance by Market Regime

Bull Markets:

- 2007 Rally: +86% (Jan-Oct 2007) vs Nifty's +54%. Momentum crushed it.

- 2009-2010 Recovery: +137% (Mar 2009 - Dec 2010) vs Nifty's +89%. Captured the explosive rebound.

- 2020-2021 Post-COVID: +139% (Apr 2020 - Dec 2021) vs Nifty's +94%. Rode the liquidity-driven rally.

Bear Markets (Where It Hurts):

- 2008 Global Financial Crisis: -68% (Jan 2008 - Mar 2009) vs Nifty's -52%. Amplified the crash.

- 2011-2012 Slowdown: -18% vs Nifty's -12%. Moderate underperformance.

- 2020 COVID Crash: -38% (Jan-Mar 2020) vs Nifty's -38%. Matched the benchmark fall.

Sideways/Choppy Markets:

- 2015-2016: +5% vs Nifty's +3%. Slight edge in range-bound conditions.

- 2018: -8% vs Nifty's -5%. Struggled when trends reversed frequently.

Pattern Recognition: Momentum is a pro-cyclical strategy. It amplifies whatever the market is doing—up or down. In strong trends (bull or bear), it outperforms. In choppy, trendless periods, it struggles with whipsaws.

Head-to-Head: Momentum vs Low Volatility

Our platform has analyzed both low volatility and momentum strategies over the identical 18.5-year period using the same rigorous tax-aware methodology. The comparison reveals complementary risk-return profiles.

| Metric | Low Volatility | Momentum | Difference |

|---|---|---|---|

| Net CAGR | 12.38% | 14.01% | Momentum +1.63% |

| Volatility | 16.70% | 22.83% | Momentum +37% higher |

| Max Drawdown | -44.55% | -70.53% | Momentum -58% deeper |

| Recovery Time | 7 months | 65 months | Momentum 9x slower |

| Final Portfolio (₹50L start) | ₹4.32 Cr | ₹5.64 Cr | Momentum +31% higher |

| Cumulative Taxes Paid | ₹25.8 lakhs | ₹64.2 lakhs | Momentum 2.5x more |

Correlation Analysis: Do They Diversify?

Pearson Correlation (Monthly Returns): 0.87

Interpretation: Strong positive correlation—the strategies move together ~87% of the time. However, the remaining 13% creates meaningful diversification opportunities:

- Opposite Direction Months: 30 out of 222 months (13.5%) where one was positive while the other was negative

- Bear Market Divergence: 2008 crisis: LV fell -39% vs Momentum's -68% = 29 percentage point protection

- Bull Market Divergence: 2020-21 rally: LV gained +77% vs Momentum's +139% = 62 percentage point opportunity cost

Key Insight: While the strategies are correlated (0.87), they diverge most when it matters—during extreme bull and bear markets. Low volatility provides downside protection when momentum crashes, while momentum captures explosive upside that low volatility misses. This imperfect correlation suggests potential benefits from combining both approaches, though we leave detailed analysis of mixed strategies for future research.

Who Wins When?

Momentum Outperformed in 53.2% of Months (118 out of 222)

Low Volatility Outperformed in 46.8% of Months (104 out of 222)

Momentum's Best Months (vs LV):

- Oct 2007: Momentum +17.4% vs LV +7.2% = +10.2% outperformance

- Jun 2007: Momentum +8.0% vs LV -0.6% = +8.7% outperformance

- Aug 2023: Momentum +2.7% vs LV -5.1% = +7.8% outperformance

Low Volatility's Best Months (vs Momentum):

- Sep 2008: LV -7.1% vs Momentum -18.4% = +11.2% protection

- Oct 2008: LV -19.6% vs Momentum -30.4% = +10.7% protection

- Jan 2025: LV -0.9% vs Momentum -11.1% = +10.2% protection

Pattern: Momentum wins big in explosive rallies. Low volatility wins (or loses less) during crashes and corrections.

The Tax Impact: 6-Month Rebalancing Cost

India's Capital Gains Tax Structure

Unlike most global backtests that ignore taxes, India's LTCG/STCG distinction creates significant drag on active strategies:

STCG (Short-Term): 15% on stocks held <1 year

LTCG (Long-Term): 10% on gains above ₹1 lakh per year for stocks held >1 year

Momentum's Tax Reality

Six-month rebalancing means:

- Positions bought in June are sold in December (6 months) = STCG at 15%

- Positions bought in December are sold in June (6 months) = STCG at 15%

- Only positions that happen to survive multiple rebalances qualify for LTCG

| Metric | Gross Returns | Net Returns (After Tax & Costs) | Tax Drag |

|---|---|---|---|

| CAGR | 15.23% | 14.01% | -1.22% annually |

| Total Tax Paid | — | ₹64.2 lakhs on ₹2.82 Cr gain | ~23% of total gains |

| vs Low Volatility Tax | — | LV paid only ₹25.8 lakhs | 2.5x higher tax bill |

Why the Tax Difference?

- Rebalancing Frequency: 6-month (momentum) vs 12-month (low volatility) = double the turnover

- STCG vs LTCG: Most momentum gains taxed at 15% vs low volatility's 10%

- Higher Absolute Gains: Momentum generates more taxable events despite similar turnover rates

Tax Optimization Consideration: If you're implementing momentum yourself, consider annual rebalancing (every December) instead of semi-annual. This would allow all positions to qualify for LTCG treatment, reducing tax drag from ~1.22% to ~0.5% annually. However, this reduces momentum exposure freshness and may impact gross returns. Our analysis suggests the trade-off is worth it for most investors.

💡 Want to Model Different Rebalancing Frequencies? BacktestIndia.com's tax-aware engine lets you test annual vs semi-annual vs quarterly rebalancing to see the exact impact on your net returns. Compare STCG vs LTCG tax drag for your specific portfolio size.

Calculate Your Tax Impact →Fundamental Quality Profile

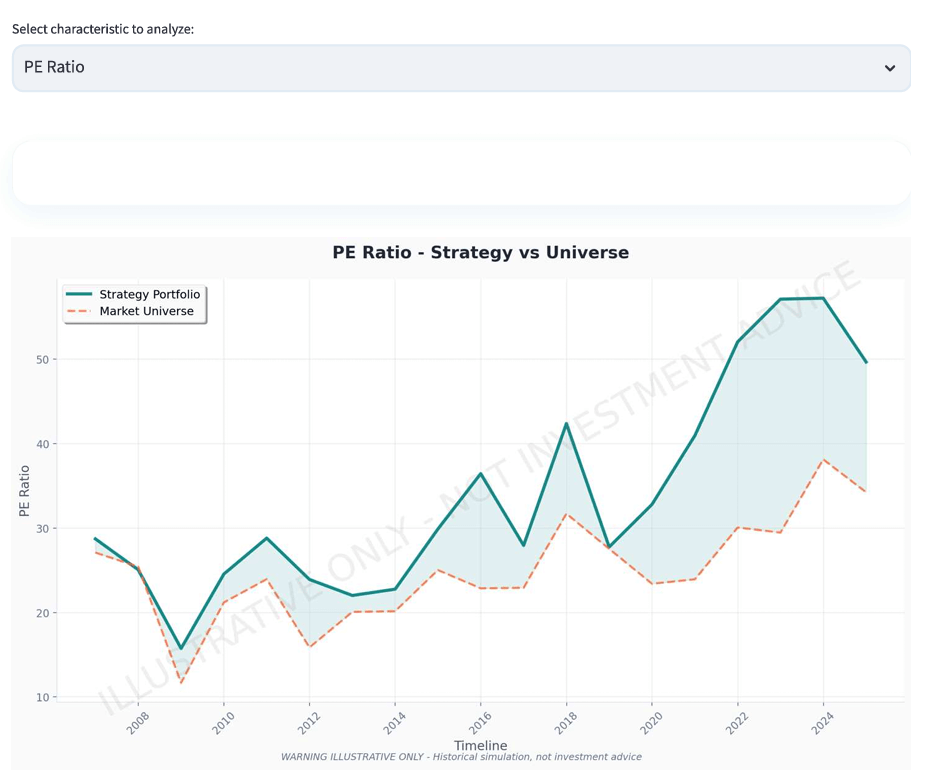

Does momentum just chase "hot" stocks regardless of fundamentals, or does it systematically select quality businesses? Our PE ratio, ROE, and EPS growth analysis reveals surprising patterns.

PE Ratio Analysis: Premium Valuations

The momentum portfolio consistently trades at 10-20x higher PE ratios than the broader universe:

| Period | Momentum Portfolio PE | Universe PE | Premium |

|---|---|---|---|

| 2008-2010 | 16-28x | 10-24x | +4-8x |

| 2010-2015 | 24-30x | 15-20x | +8-10x |

| 2015-2020 | 29-36x | 22-32x | +5-8x |

| 2020-2024 | 33-54x | 23-37x | +10-17x |

Interpretation:

- Momentum ≠ Value: The strategy systematically selects expensive stocks (high PE) rather than cheap ones

- Growth Premium: Market pays up for stocks with strong price momentum, often linked to earnings growth expectations

- Valuation Risk: Current PE of 54x (as of 2024) suggests potential mean reversion risk if growth disappoints

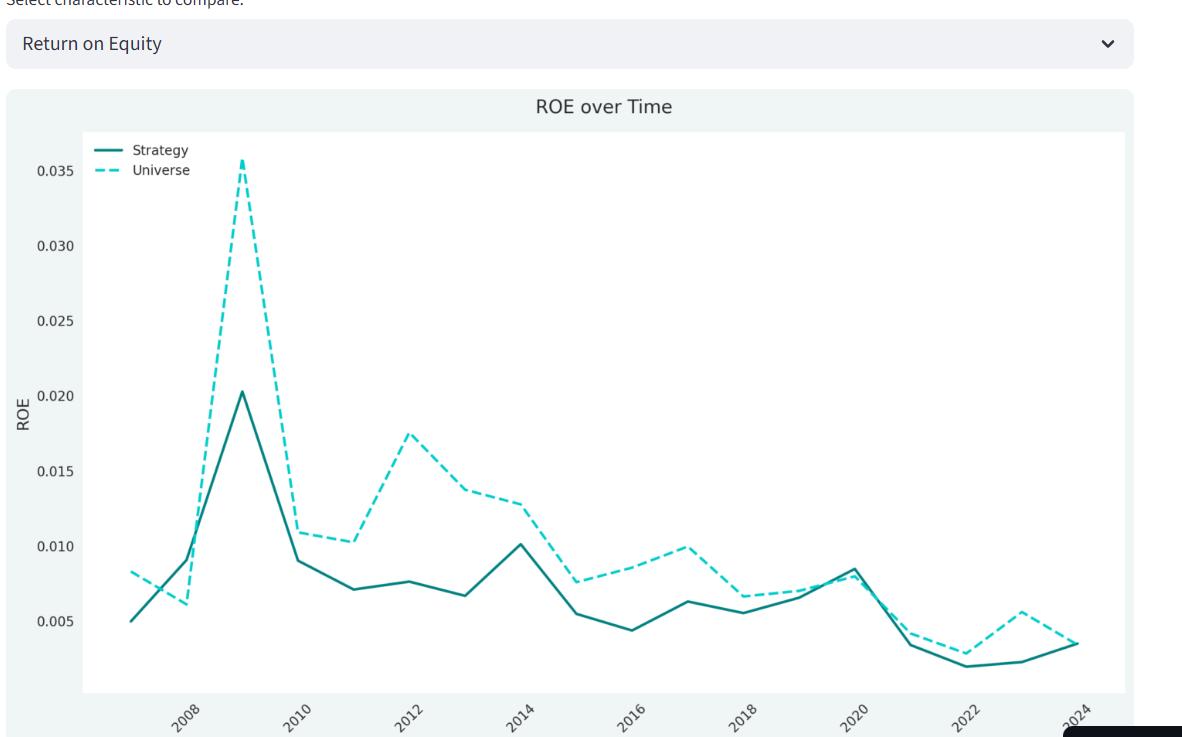

ROE Analysis: Profitability Volatility

Data Period: December 2006 - March 2024

Unlike low volatility stocks which maintain stable ROE, momentum stocks show significant profitability swings:

| Period | Momentum Portfolio ROE | Universe ROE | Pattern |

|---|---|---|---|

| 2008-2010 | 0.5-2.0% | 1.0-3.7% | Below universe (post-crisis reset) |

| 2010-2013 | 0.7-1.0% | 1.0-1.7% | Convergence period |

| 2013-2019 | 0.5-1.0% | 0.8-1.0% | Parity with universe |

| 2019-2024 | 0.2-0.9% | 0.3-0.6% | Slight outperformance |

Key Insight: Momentum doesn't select for consistently high ROE like quality or low volatility strategies. Instead, it captures stocks during their growth phase—sometimes with improving ROE, sometimes with temporarily depressed profitability that's recovering.

EPS Growth Analysis: Capturing Growth Inflections

Data Period: December 2006 - March 2024

Here's where momentum truly shines—capturing extreme earnings growth periods:

| Period | Momentum EPS Growth (1Y) | Universe EPS Growth (1Y) | Insight |

|---|---|---|---|

| 2008-2009 | 32-39% | 25-46% | Captured pre-crisis momentum |

| 2009-2010 | 14-68% | 5-23% | Explosive recovery capture |

| 2010-2015 | 18-34% | 5-18% | Consistent +10-15% premium |

| 2015-2020 | 6-35% | 3-17% | Higher volatility, higher average |

| 2020-2024 | 17-46% | 0-26% | Captured COVID winners |

Critical Observation (2009-2010 Spike to 68%):

The momentum portfolio captured the post-GFC earnings recovery explosion—68% EPS growth vs universe's 23%. This is momentum's superpower: identifying and concentrating in companies experiencing earnings inflections before the market fully recognizes them.

Fundamental Story:

- Momentum ≠ Fundamentals-Blind: Despite the "trend-following" label, momentum systematically selects stocks with superior earnings growth

- Growth at a Premium: Market pays up (high PE) for stocks showing strong EPS growth trends

- Volatility Trade-Off: EPS growth is highly volatile (6% to 68% swings) vs low volatility's stable 10-20% bands

Who Should Use Momentum vs Low Volatility?

Use Momentum If You:

- Have 10+ year investment horizon: Need time to recover from -70% drawdowns

- Can stomach extreme volatility: Won't panic-sell when portfolio falls 40-50%

- Want maximum absolute returns: Willing to accept higher risk for higher CAGR

- Are young with high income: Can dollar-cost-average through crashes

- Believe in trend continuation: Comfortable buying "expensive" stocks that keep rising

- Track markets actively: Can rebalance semi-annually with discipline

Use Low Volatility If You:

- Prioritize capital preservation: Can't afford -70% drawdowns

- Want better sleep: Prefer 16% volatility over 22%

- Are near retirement: Need stable, defensive equity exposure

- Seek tax efficiency: Annual rebalancing = LTCG vs momentum's STCG

- Believe in quality: Prefer stable, profitable companies over growth stories

- Want crisis protection: Recover 9x faster than momentum (-44% vs -70%)

The Risk Tolerance Test

Scenario: You invest ₹1 Cr in Oct 2007. By Dec 2008, it's worth ₹29.5 lakhs.

Question 1: Can you hold without selling?

Question 2: Can you buy MORE at the bottom?

Question 3: Can you wait 5.4 years to break even?

If you answered "yes" to all three, you might have the temperament for momentum investing. If you hesitated on even one, stick with low volatility or diversified index funds.

🎯 Test Your Risk Tolerance with Real Numbers: Use BacktestIndia.com to run a momentum backtest with YOUR actual capital amount. See the exact rupee losses you would have experienced during 2008, 2020, and 2022. Better to know now than panic-sell in the next crash.

Calculate My Drawdown Risk →What Could Go Wrong? Limitations & Risks

1. Momentum Crashes Are Catastrophic

The Problem: When momentum reverses, losses are severe and sudden. Unlike gradual mean reversion, momentum crashes happen in weeks.

Historical Evidence:

- Sep-Oct 2008: -42% in 2 months

- Feb-Mar 2020: -32% in 1 month

- Jan 2025: -11% in 1 month

Why It Happens: Crowded trades unwind violently when trends reverse. Everyone rushes for the exit simultaneously.

2. Extended Recovery Periods

Reality Check: Despite 34% higher terminal wealth, momentum took 65 months to recover from peak drawdown vs Nifty's 60 months and low volatility's 7 months.

Psychological Toll: Watching your portfolio underwater for 5+ years tests even the most disciplined investors.

3. Tax Drag from Frequent Rebalancing

The Numbers: ₹64.2 lakhs paid in taxes vs low volatility's ₹25.8 lakhs—2.5x higher despite only 2x rebalancing frequency.

STCG Trap: Six-month holding periods trigger 15% tax vs 10% LTCG, creating 50% higher tax rates on gains.

4. Capacity Constraints at Scale

Liquidity Reality: This backtest assumes ₹50 lakh initial capital. At ₹50+ Cr portfolio size:

- Top 200 stocks have lower average daily volumes than Top 100

- Market impact costs increase materially (1-2% for mid-cap positions)

- Rebalancing execution becomes multi-day process, reducing momentum capture

Sweet Spot: ₹20 lakh - ₹10 Cr. Below this, transaction costs hurt. Above this, liquidity constraints bite.

5. Regime Dependency

Not All Markets Are Equal:

- Strong Trends (2007, 2009-10, 2020-21): Momentum crushes it (+86%, +137%, +139%)

- Choppy Markets (2015-16, 2018): Whipsaws kill returns (-8% in 2018)

- Bear Markets (2008): Amplifies crashes (-68% vs Nifty's -52%)

The Problem: You can't predict which regime is coming. Momentum requires commitment through all conditions.

6. Survivorship Bias (Partially Addressed)

While our dataset includes recently delisted companies, companies that delisted before our data coverage began (pre-2006) are not included. This may have some impact on historical returns, though difficult to quantify precisely.

Key Takeaways: What This Means for Investors

✅ Evidence-Based Conclusions

- Momentum works in India: +3.59% annual alpha over 18.5 years after all costs and taxes, with 34% higher terminal wealth than Nifty

- The returns come with brutal risk: -70.53% drawdown, 65-month recovery, 37% higher volatility than low volatility strategies

- Tax-aware analysis is critical: 6-month rebalancing triggers significant STCG drag (1.22% annually), 2.5x higher tax bill than annual strategies

- Momentum captures growth inflections: Systematically selects stocks with superior EPS growth (68% spike in 2009 vs universe's 23%)

- Complementary to low volatility: 0.87 correlation means they move together mostly, but diverge when it matters (bear vs bull markets)

- Recent performance remains strong: +84% cumulative return (2022-2025) vs low volatility's +46%, suggesting the anomaly persists

⚠️ Important Caveats

- Not suitable for most retail investors: Requires exceptional risk tolerance, long horizon, and emotional discipline

- Past crashes will repeat: Expect multiple -40% to -70% drawdowns over any 20-year period

- Momentum crashes are violent: Unlike gradual corrections, momentum reverses suddenly (weeks, not months)

- Tax optimization matters: Consider annual rebalancing instead of semi-annual to reduce STCG drag

- Capacity constraints exist: Works best for ₹20L - ₹10 Cr portfolios; beyond this, liquidity issues emerge

🔄 The Momentum-Low Volatility Spectrum

Think of factor investing as a spectrum:

- Low Volatility: 12.38% CAGR, -44% drawdown, 7-month recovery = Defensive

- ???: Somewhere in between = Balanced

- Momentum: 14.01% CAGR, -70% drawdown, 65-month recovery = Aggressive

The 0.87 correlation suggests these strategies, while highly correlated, offer different risk-return profiles that may complement each other in a diversified portfolio. Investors might consider their personal risk tolerance when positioning along this spectrum.

Frequently Asked Questions

Q1: Is momentum investing suitable for conservative investors?

A: Absolutely not. Momentum requires exceptional risk tolerance. The strategy experienced a -70.53% drawdown—worse than Nifty 50's -55.12%. If a ₹1 Cr portfolio falling to ₹30 lakhs would cause you to panic-sell, avoid pure momentum strategies. Consider our defensive low volatility approach instead for safer equity exposure.

Q2: How does momentum compare to low volatility investing in India?

A: Momentum delivers higher returns (14.01% vs 12.38% CAGR) but with significantly higher risk:

| Metric | Low Vol | Momentum | Difference |

|---|---|---|---|

| Drawdown | -44.55% | -70.53% | -58% deeper |

| Recovery | 7 months | 65 months | 9x longer |

| Volatility | 16.70% | 22.83% | +37% higher |

| Taxes Paid | ₹25.8L | ₹64.2L | 2.5x more |

The strategies have 0.87 correlation—moving together most of the time but diverging during extreme market conditions. Low volatility protects better in crashes (-39% vs -68% in 2008). Momentum captures more in rallies (+139% vs +77% in 2020-21).

Q3: What is the tax impact of momentum investing in India?

A: Six-month rebalancing triggers significant STCG (15% tax) vs annual rebalancing strategies that qualify for LTCG (10% tax). Over 18.5 years:

- Momentum: Paid ₹64.2 lakhs in cumulative taxes (1.22% annual drag)

- Low Volatility: Paid ₹25.8 lakhs in cumulative taxes (0.47% annual drag)

- Tax Differential: 2.5x higher tax bill despite starting with same ₹50 lakh capital

Optimization: Consider annual rebalancing (every December) instead of semi-annual to allow LTCG qualification. This reduces tax drag to ~0.5% annually, though may slightly reduce gross returns.

Q4: Why does momentum work in stock markets?

A: Momentum persists due to systematic behavioral biases:

- Under-Reaction: Investors slowly incorporate new information, causing trends to continue 6-12 months

- Herding: Social proof drives buying after initial trends establish, amplifying movements

- Anchoring: Investors anchor to past prices, delaying response to fundamentals

- Disposition Effect: Retail holds losers too long, sells winners too quickly, allowing trends to persist

These patterns have been documented across 40+ countries over 90+ years, suggesting deep behavioral roots rather than temporary inefficiency.

Q5: Can I replicate this strategy today?

A: Yes, but with critical considerations:

Current Conditions (2025):

- Momentum stocks trade at 54x PE—near historical highs

- Recent 3-year performance remains strong (+84% cumulative 2022-2025)

- Valuations suggest potential mean reversion risk

Implementation Requirements:

- Minimum ₹20-30 lakhs for 30-stock diversification

- Discipline to rebalance semi-annually regardless of emotions

- 10+ year investment horizon (non-negotiable)

- Strong stomach for -40% to -70% drawdowns

Recommendation: Test the strategy with current data on BacktestIndia.com. Run a backtest using only 2020-2025 data to see how it performs in recent conditions before committing capital.

Q6: What's the minimum capital needed for momentum investing?

Minimum: ₹20-30 lakhs (30 stocks × ₹67,000-1,00,000 each) provides proper diversification.

Optimal: ₹50 lakhs - ₹10 Cr provides:

- Sufficient position sizes (₹1.7-3.3 lakh per stock)

- Transaction costs <0.15% per trade

- Adequate liquidity in Top 200 universe

Above ₹10 Cr: Consider expanding to 50-60 stocks or splitting across multiple strategies to reduce market impact in mid-cap names.

Q7: How often should I rebalance a momentum portfolio?

Our Testing: Semi-annual (6-month) rebalancing balances momentum freshness with tax efficiency.

| Frequency | Pros | Cons |

|---|---|---|

| Quarterly | Freshest momentum signals | 100% STCG, 4x transaction costs |

| Semi-Annual | Good signal freshness, 2x costs | ~80% STCG, 1.22% tax drag |

| Annual | LTCG qualification, lowest costs | Slower momentum adjustment |

Our Recommendation: For Indian investors, annual rebalancing (every December) may be optimal, reducing tax drag by ~0.7% annually while maintaining reasonable momentum exposure.

Q8: Does momentum work in mid-cap and small-cap stocks?

Preliminary Evidence: Yes, momentum appears even stronger in mid-caps (Rank 101-300), but with critical trade-offs:

Mid-Cap Momentum:

- Higher potential returns (momentum effect stronger in less efficient markets)

- But: 3-5x higher transaction costs (0.3-0.5% per trade)

- But: Severe liquidity constraints above ₹2-5 Cr

- But: Higher delisting risk (survivorship bias issues)

Recommendation: Start with Top 200 (large + mid cap) for amounts above ₹50 lakh. Test pure mid-cap (Rank 101-300) only with ₹10-50 lakh allocations to manage liquidity risk.

Test Momentum Strategies Yourself

This analysis used a specific configuration: Top 200 stocks, 30 highest momentum, equal weight, semi-annual rebalancing. But what if you want to test different parameters?

BacktestIndia.com lets you:

- Modify rebalancing frequency (annual vs semi-annual)

- Test different universes (Top 100, 200, 300)

- Combine momentum with other factors (value, quality, low vol)

- See automatic LTCG/STCG tax calculations

- Compare against Nifty 50 and custom benchmarks

- Export full transaction logs and holdings history

22+ Years NSE Data | Tax-Aware Engine | Multi-Factor Analysis

Conclusion: Momentum for the Brave

Over 18.5 years, momentum investing delivered exactly what it promises: higher returns for those who can stomach the volatility.

14.01% CAGR with 1.7x wealth creation vs Nifty. -70.53% drawdown with 5.4-year recovery periods. 37% higher volatility than low volatility strategies. 2.5x higher tax bills.

This isn't a strategy for everyone. It's not a strategy for most people. It's a strategy for disciplined investors with exceptional risk tolerance, long time horizons, and the emotional fortitude to buy when portfolios are down 60%.

The behavioral biases that make momentum work—under-reaction, herding, anchoring—are deeply embedded in human psychology. These patterns have persisted for 90+ years globally and 18+ years in our Indian data. There's no reason to believe they'll disappear.

But knowing momentum works and actually implementing it are entirely different things. Paper returns of 14% mean nothing if you panic-sell at the bottom of a -70% crash.

For brave, disciplined, long-term investors, momentum represents one of the highest-returning systematic strategies in Indian equities. For everyone else, there are safer paths to wealth creation.

Choose wisely. Your risk tolerance matters more than historical returns.

⚠️ EDUCATIONAL TOOL DISCLAIMER

EDUCATIONAL ANALYSIS ONLY: This backtest represents a hypothetical simulation using historical data. Past performance does not predict future results. No liability for calculation errors or data inaccuracies.

NOT INVESTMENT ADVICE: This analysis does not constitute personalized investment advice or recommendations. It demonstrates systematic factor investing concepts for educational purposes only.

CONSULT PROFESSIONALS: Before implementing any systematic strategy with real capital, consult a SEBI-registered Investment Adviser to assess suitability for your specific circumstances, goals, and risk tolerance.

HIGH RISK WARNING: Momentum investing involves substantial risk including severe drawdowns exceeding -70%, extended recovery periods, and significant volatility. Only suitable for investors with exceptional risk tolerance and long-term horizons.

About This Analysis

Data Source: EODHD Financial APIs (December 2006 - June 2025)

Platform: BacktestIndia.com Portfolio Strategy Analyzer

Methodology: Semi-annual rebalancing, equal-weighted, top 200 market cap universe

Compliance: Educational tool under SEBI Investment Advisers Regulations 2013, Regulation 3(1)(d) exemption

Author: Ishani Tapan Desai

Platform: BacktestIndia.com

Published: December 7, 2025

Contact: ishani.desai20@yahoo.com

Copyright: © 2025 Tapan Desai. Government of India Copyright Certificate No. SW-2025021891.

Related Analysis: Compare momentum's aggressive profile with our analysis of low volatility investing in India, which delivers 12.38% CAGR with only -44% drawdowns and 7-month recovery periods—demonstrating complementary risk-return characteristics.